STABILIS ENERGY ANNOUNCES SECOND QUARTER 2020 RESULTS Company Sees U.S. Activity Recovering and Mexico Acceleration Beginning in Q3

ACCESS Newswire

06 Aug 2020, 04:25 GMT+10

HOUSTON, TX / ACCESSWIRE / August 5, 2020 / Stabilis Energy, Inc., ('Stabilis' or the 'Company') (OTCQX:SLNG) today reported its financial results for its second quarter ended June 30, 2020.

Sequential Quarter Results

For the second quarter ('current quarter') Stabilis reported revenues of $5.0 million, a 64% decrease from the quarter ended March 31, 2020 ('preceding quarter') primarily due to the impact of the COVID-19 crisis, the related shutdown of many businesses, and the resulting decrease in industrial activity. Revenues from Stabilis' LNG segment decreased by $8.5 million (68%) in the current quarter on a 62% decrease in gallons delivered. The Company delivered 4.6 million LNG gallons to customers in the quarter. Utilization of the George West liquefier declined to 31% in the current quarter versus 74% in the preceding quarter. Power Delivery segment revenues fell by 25% to $1.0 million.

Adjusted earnings before interest, taxes, depreciation and amortization ('Adjusted EBITDA') was a loss of $0.8 million in the current quarter, a $2.3 million decrease from the preceding quarter. The net loss for the current quarter increased to $3.5 million compared to a net loss of $1.1 million in the preceding quarter.

Calendar Quarter Results

Revenues in the current quarter decreased $6.1 million (55%) compared to the quarter ended June 30, 2019 ('prior year quarter') as a result of the COVID-19 crisis, partially offset by revenues resulting from the closing of the Company's business combination with American Electric Technologies ('AETI') subsequent to the prior year quarter. LNG segment revenues decreased by $7.1 million (64%). Utilization of the George West liquefier was 31% in the current quarter versus 76% in the prior year quarter.

Adjusted EBITDA in the current quarter decreased by $2.5 million and the net loss for the current quarter increased by $2.4 million compared to the prior year quarter.

Impact of COVID-19

The COVID-19 pandemic had a significant impact on activity levels during the second quarter in both the LNG and Power Delivery segments. The LNG segment, which is focused on North America, experienced activity declines and project delays across most of our customer sectors, particularly with upstream oil and gas and industrial customers.

The Company's Power Delivery segment has its primary operational presence in Brazil, which currently has the second highest number of reported COVID-19 cases behind the United States. Our Brazilian activities were impacted in the second quarter by shutdowns, work restrictions and quarantines at customer sites.

BOMAY, the Company's joint venture in China, returned to profitability in the second quarter as normal operations resumed.

Outlook and Liquidity

The Company experienced a low point in LNG gallons delivered in May and volumes have increased in each subsequent month since then. Sales activity is improving in multiple sectors, including aerospace, infrastructure, and marine. We have booked several new contracts with U.S. based customers during the quarter, including a contract to provide LNG to a large aerospace customer and a contract to support a major marine bunkering project.

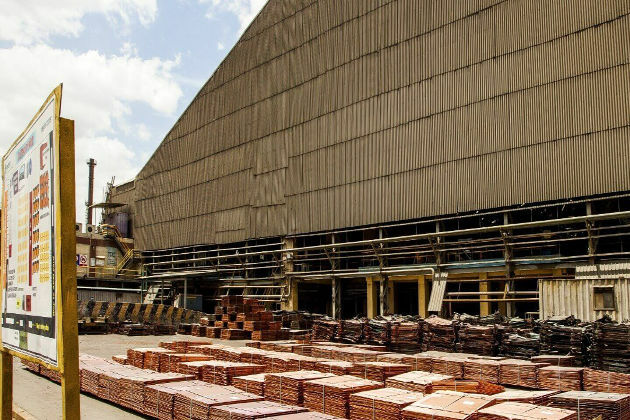

We have signed contracts with several new customers in Mexico, including a greenhouse operator and a provider of remote power generation services. Additionally, we have contracts with several Mexican mining customers in the final stages of negotiation.

We believe that these new customers in the U.S. and Mexico will significantly diversify our end market exposure and, thereby, reduce our reliance on the upstream oil and gas sector and provide a meaningful improvement in current utilization for our George West liquefier.

While we are encouraged by the recent activity increases, contract awards and resurgence in bidding activity in our LNG business, at this time it remains uncertain how quickly we will be able to return to pre-pandemic revenue and EBITDA levels.

In Brazil, our backlog is currently at record levels. The timing of converting the backlog to revenue is dependent on a variety of factors including the Brazilian government's response to the pandemic and our customers' pace and timing of activity.

During the second quarter, we received a cash dividend of $1.8 million from our Chinese joint venture and ended the quarter with a cash balance of $7.1 million.

Conference Call

Management will conduct a conference call on Thursday, August 6, 2020 at 11:00 a.m. eastern time (10:00 a.m. central). Individuals in the United States and Canada who wish to participate in the conference call can access the live webcast at https://www.webcaster4.com/Webcast/Page/2256/36089 or dial +1 877-407-8133. International callers should dial +1 201-689-8040. A replay of the call will be available until August 13, 2020. Individuals in the United States and Canada who wish to listen to the replay should dial +1 877-481-4010; passcode 36089. International callers should dial +1 919-882-2331; passcode 36089. A replay of the call also will be available on the Stabilis website (www.stabilisenergy.com).

About Stabilis

Stabilis Energy, Inc. is a vertically integrated provider of small-scale liquefied natural gas ('LNG') production, distribution and fueling services to multiple end markets in North America. Stabilis has safely delivered over 200 million gallons of LNG through more than 20,000 truck deliveries during its 15-year operating history in the LNG industry, which we believe makes us one of the largest and most experienced small-scale LNG providers in North America. Stabilis' customers use LNG as a fuel source in a variety of applications in the industrial, energy, mining, utilities and pipelines, commercial, and high horsepower transportation markets. Stabilis' customers use LNG as an alternative to traditional fuel sources, such as distillate fuel oil and propane, to lower fuel costs and reduce harmful environmental emissions. Stabilis' customers also use LNG as a 'virtual pipeline' solution when natural gas pipelines are not available or volumes are curtailed. To learn more, visit www.stabilisenergy.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release includes 'forward-looking statements' within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and within the meaning of Section 27a of the Securities Act of 1933, as amended, and Section 21e of the Securities Exchange Act of 1934, as amended. Any actual results may differ from expectations, estimates and projections presented or implied and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as 'can', 'believes,' 'anticipates,' 'expects,' 'could,' 'will,' 'plan,' 'may,' 'should,' 'predicts,' 'potential' and similar expressions are intended to identify such forward-looking statements.

Such forward-looking statements relate to future events or future performance, but reflect the parties' current beliefs, based on information currently available. Most of these factors are outside the parties' control and are difficult to predict. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. Factors that may cause such differences include, among other things: the future performance of Stabilis, future demand for and price of LNG, availability and price of natural gas, unexpected costs, and general economic conditions.

The foregoing list of factors is not exclusive. Additional information concerning these and other risk factors is contained in the Risk Factors in Item 1A of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 16, 2020 which is available on the SEC's website at www.sec.gov or on the Investors section of our website at www.stabilisenergy.com. All subsequent written and oral forward-looking statements concerning Stabilis, or other matters attributable to Stabilis, or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Stabilis does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in their expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

Stabilis Energy, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(Unaudited)

(in thousands, except share and per share data)

Revenues by Segment

(unaudited in thousands)

Gallons Delivered

(unaudited in thousands)

Stabilis Energy, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except share and per share data)

Non-GAAP Measures

Our management uses EBITDA and Adjusted EBITDA to assess the performance and operating results of our business. EBITDA is defined as Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for certain special items that occur during the reporting period, as noted below. We include EBITDA and adjusted EBITDA to provide investors with a supplemental measure of our operating performance. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles in the U.S. ('GAAP'). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for management's discretionary use, as they do not consider certain cash requirements, such as debt service requirements. Because the definition of EBITDA and Adjusted EBITDA may vary among companies and industries, it may not be comparable to other similarly titled measures used by other companies. The following table provides a reconciliation of net loss, the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA (in thousands).

(1) Special Items include the following:

Transaction and share registration costs related to AETI, Chart, and Diverse transactions of $0.2 million and $0.4 million in the three and six months ended June 30, 2019, respectively.

Investor Contact:

Andrew Puhala

Chief Financial Officer

832-456-6500

[email protected]

SOURCE: Stabilis Energy

View source version on accesswire.com:

https://www.accesswire.com/600485/STABILIS-ENERGY-ANNOUNCES-SECOND-QUARTER-2020-RESULTS-Company-Sees-US-Activity-Recovering-and-Mexico-Acceleration-Beginning-in-Q3

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Pennsylvania Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Pennsylvania Sun.

More InformationBusiness

SectionWK Kellogg sold to Ferrero as food giants chase shelf power

BATTLE CREEK, Michigan: In a major consolidation of iconic food brands, WK Kellogg has agreed to be acquired by the owner of Ferrero...

Filmmaker joins biotech effort to bring back extinct giant bird

WASHINGTON, D.C.: Filmmaker Peter Jackson's lifelong fascination with the extinct giant New Zealand flightless bird called the moa...

India seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...

AI boom propels Nvidia to historic market cap milestone

SAN FRANCISCO, California: Nvidia, the Silicon Valley chipmaker at the heart of the artificial intelligence boom, this week briefly...

AI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

Business

SectionWK Kellogg sold to Ferrero as food giants chase shelf power

BATTLE CREEK, Michigan: In a major consolidation of iconic food brands, WK Kellogg has agreed to be acquired by the owner of Ferrero...

Filmmaker joins biotech effort to bring back extinct giant bird

WASHINGTON, D.C.: Filmmaker Peter Jackson's lifelong fascination with the extinct giant New Zealand flightless bird called the moa...

India seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...

AI boom propels Nvidia to historic market cap milestone

SAN FRANCISCO, California: Nvidia, the Silicon Valley chipmaker at the heart of the artificial intelligence boom, this week briefly...

AI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...